Decentralized Finance (DeFi) is an emerging new financial ecosystem built on the back of blockchain technology. With over $2 trillion locked in cryptocurrencies and the rapid adoption of new DeFi products by retail users and institutions, it's natural to wonder how this new financial ecosystem will disrupt the traditional financial sector. We seek to investigate current patterns of usage in DeFi lending protocols, and quantify risk and user behaviors across various protocols. Our strategy is to exploit powerful AI models and technology developed for transaction data such as those arising in health and commerce. For example, we can utilize temporal clustering to characterize different types of users and then use these in a dashboard to understand how usage of lending protocols changes over time.

We are developing these methods to analyze any lending protocol in the DeFi sphere. As we develop these methods, we are testing them on data that we've collected from the AAVEv2 protocol, which is one of the largest lending protocols in DeFi. This data has been collected using and API provided by The Graph, which compiles data directly from AAVE. We welcome suggestions and collaborations to further extend our analyses to address compelling DeFi questions.

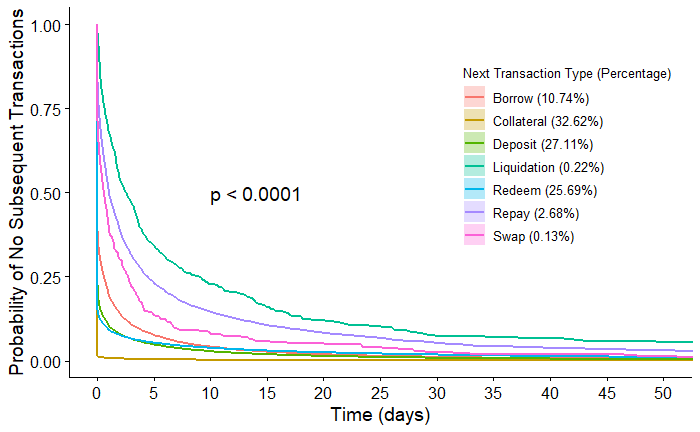

Liquidations, the DeFi equivalent of defaults on loans, can help us learn about risky behavior in lending protocols. We are using statistical methods and advanced AI to learn about risk in DeFi, starting from liquidations in lending protocols. Can we identify which conditions in the market create risk as a whole? Can we effectively use AI to learn what behavioral patterns are good predictors that a user will eventually liquidate? Which users are having the biggest influence on liquidation? We explore these questions and more in our most recent paper, "DeFi Survival Analysis: Insights into Risks and User Behavior," recently submitted to MARBLE 2022: The 3rd International Conference on Mathematical Research for Blockchain Economy (July 2022)

- Aaron Green, Christopher Cammilleri, John S. Erickson, Oshani Seneviratne, Kristin P. Bennett, "Risky Business? Deep Dives into DeFi." CRAFT Executive Summary

- Aaron Green, Christopher Cammilleri, John S. Erickson, Oshani Seneviratne, Kristin P. Bennett, "DeFi Survival Analysis: Insights into Risks and User Behavior." Proceedings of MARBLE 2022: The 3rd International Conference on Mathematical Research for Blockchain Economy (July 2022). To appear.

- Xiao Shou, Tian Gao, Dharmashankar Subramanian, Debarun Bhattacharjya, and Kristin Bennett, "Concurrent Multi-Label Prediction in Event Streams." Proceedings of the AAAI Conference on Artificial Intelligence. (To appear 20230.

- Live app (prototype): DeFi Survival Analysis Toolkit

- github: DeFi Survival Analysis Toolkit

- DeFi Data Engine:

- Dockerhub deployment: https://hub.docker.com/r/dataincite/defi-data-engine

- github (prototype): https://github.rpi.edu/DataINCITE/IDEA-DeFi-CRAFT

Data INCITE Undergraduate Students Spring 2023: Connor Flynn, Michael Giannattassio

Data INCITE Undergraduate Students (Fall 2022): Kacy Adams, Michael Giannattasio, Leyi Lin, Shuyu Meng, Kris Tu, Matthew Uryga, Ken Wang, Yu-Kai Wang, Conor Flynn, Michael Giannattasio

Data INCITE Undergraduate Students (Summer 2022): Conor Flynn, Michael Giannattasio

Data INCITE Undergraduate Students (Fall 2021): Christopher C. Cammilleri, Duke Kwon, Ziye Luo, Kaiwen Min, Soumya Mishra, Cole W. Paquin, Jason P. Podgorski, Roman Vakhrushev, Jaimin Vyas

Graduate Students: Aaron Green

Faculty and Staff: Kristin P. Bennett, Oshani Seneviratne, John S. Erickson

| This work has been supported in part by the Center for Research toward Advancing Financial Technologies (CRAFT), the first-ever National Science Foundation (NSF) grant to create an industry-university cooperative research center devoted specifically to financial technology and science. |